Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. After preparing yourtrial balance this month, you discover that it does not balance.The debit column shows $2,000 more dollars than the credit column.You decide to investigate this error. Once all balances are transferred to the unadjusted trialbalance, we will sum each of the debit and credit columns. Thedebit and credit columns both total $34,000, which means they areequal and in balance.

Company

Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. In the end, making sure you have a UTB to compare with your ATB is important because it will ensure that all accounts in your organization are accurate and complete. The Unadjusted Trial Balance (UTB) document summarizes all of the accounts in an organization at a single point or period.

Great! The Financial Professional Will Get Back To You Soon.

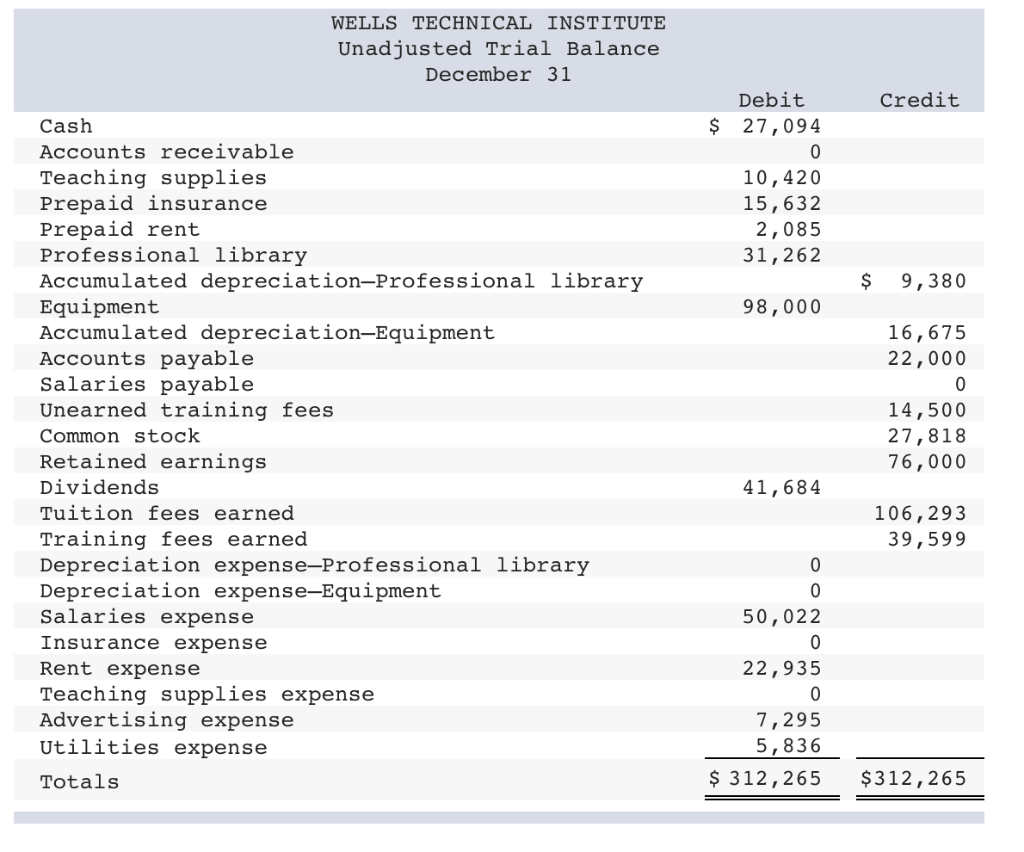

In accordance with double entry accounting, both of the debit and credit columns are equal to each other. A balanced trial balance hints at no apparent accounting error, whereas discrepancies imply an error somewhere in the account balances. Since the debit and credit columns equal each other totaling a zero balance, we can move in the year-end financial statement preparation process and finish the accounting cycle for the period. The following unadjusted trial balance has been prepared from the ledger accounts of Company A. If a company creates financial statements on a monthly basis, the accountant would print an unadjusted trial balance at the end of each month to initiate the process of creating financial statements. Alternatively, if the company only creates financial statements once a quarter, you would print the unadjusted trial balance on a quarterly basis.

- As with the accounting equation, these debit and credit totals must always be equal.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- If it’s out of balance, something is wrong and the bookkeeper must go through each account to see what got posted or recorded incorrectly.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Three Types of Trial Balance

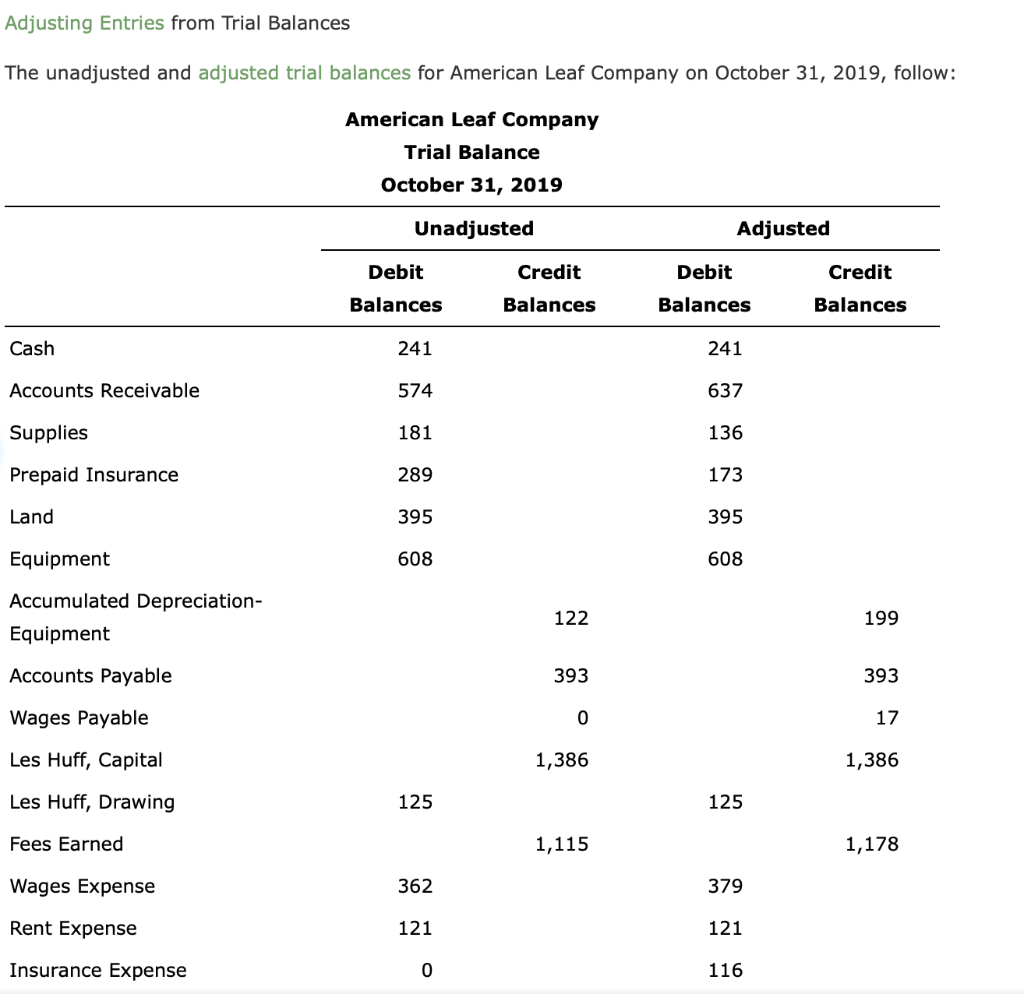

The year-end adjusting journal entries include booking prepaid and accrual accounts, recording dividends issued, and the closing entries for the year of the year. These adjusted account balances are then used to create the year-end financial statements. This report is a standard one that can be issued by many accounting software packages. Once all ledger accounts and their balances are recorded, thedebit and credit columns on the trial balance are totaled to see ifthe figures in each column match each other. The final total in thedebit column must be the same dollar amount that is determined inthe final credit column.

A more complete picture of company position develops after adjustments occur, and an adjusted trial balance has been prepared. These next steps in the accounting cycle are covered in The Adjustment Process. Unadjusted Trial Balance is a direct report extracted by a business from its Double Entry Accounting system. A trial balance is an accounting report that lists the ending balances of general ledger accounts to ensure the debit and credit balances are equal. It serves to be the source of all financial statements that a company creates.

Usually only active accounts with year-end balance are included in the TB because accounts with zero balances don’t make it on the financial statements. For example, if a company had a vehicle at the beginning of the year and sold it before year-end, the vehicle account would not show up on the year-end report because it’s not an active account. Find an example balance sheet and use our free balance sheet template to review your company’s financial position. One way to find the error is to take the difference between the two totals and divide the difference by two.

If the final balance in the ledger account (T-account) is a credit balance, you will record the total in the right column. An unadjusted trial balance is a listing of all the company’s accounts and their balances at a specific point in time, usually at the end of an accounting period before any adjusting entries have been made. There are eight steps in the accounting cycle, the fourth step being the preparation of an unadjusted trial balance. Companies have to have an organized and adjusted trial balance before they prepare their financial statements to reflect the liabilities, assets, revenues, and expenses of the organization.

Start entering the balances for each account into the 1st column of an unadjusted trial balance spreadsheet (UBTB). Create a master list of accounts (assets, liabilities, equity, revenue & expenses) used in your company’s accounting system. This balance is transferred to the Cash account in the debitcolumn on the unadjusted trial balance. These credit balances would transferto the credit column on the unadjusted trial balance. Accounts Payable ($500), Unearned Revenue ($4,000), Common Stock ($20,000), and Service Revenue ($9,500) all have credit final balances in their T-accounts.

While an unadjusted trial balance may uncover mathematical errors, the following types help in eliminating accounting errors and ensuring accurate financial statements. Within the trial balance, debit balances typically feature asset and expense accounts, while credit balances represent the company’s liabilities, capital, and revenue. A trial balance sheet is a report that single vs double taxation lists the ending balances of each account in the chart of accounts in balance sheet order. Bookkeepers and accountants use this report to consolidate all of the T-accounts into one document and double check that all transactions were recorded in proper journal entry format. As you can see, all the accounts are listed with their account numbers with corresponding balances.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Unfortunately, you will have to go back through one step ata time until you find the error. Find out if you can receive wire transfers to your PayPal account and learn about alternative methods for receiving money.

CV0.net vous accompagne dans votre recherche d'emploi et permet aux entreprises de partager leurs offres de jobs gratuitement !

CV0.net vous accompagne dans votre recherche d'emploi et permet aux entreprises de partager leurs offres de jobs gratuitement !