All three major credit bureaus — Equifax, Experian and TransUnion — will include rent payment information in credit reports if they receive it. Credit reports in turn provide the data that go into your credit scores.The corporation prepaid the rent for next two months making an advanced payment of $1,800 cash. Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. In short, organizations will now have to record both an asset and a liability for their operating leases.

Lease modifications- common accounting issues for prepaid rent

Since accrual basis is a more popular and widely used accounting system, we will focus on that. However, we will also talk about the treatment of different economic transactions on a cash basis. By following these steps, organizations can ensure that they account for prepaid rent accurately and maintain proper financial records. Prepaid rent also provides tenants with financial stability, as they can budget their expenses knowing prepaid rent assets or liabilities they have already paid for a certain period of rental occupancy. Whether prepaid rent is an asset is often asked by businesses and individuals trying to understand the implications of this financial arrangement. This journal would be repeated at the end of May and June until the pre paid rent of 3,000 has been charged as an expense to the income statement and the pre paid rent account balance has been reduced to zero.

Non-Current Assets Vs. Current Assets

In the 12th month, the final $10,000 will be fully expensed and the prepaid account will be zero. Explore the proper handling of prepaid rent in accounting, from balance sheet recognition to financial statement reporting. Another potential benefit is that prepaid rent can improve a company’s creditworthiness, as it is considered an asset that you can use as collateral for loans or other financings. There are a few potential implications of considering prepaid rent as an asset. One potential benefit is that it can improve a company’s liquidity position, as prepaid rent can be converted into cash if needed.

Accounting for Prepaid Rent

The “interest” component in Year 2 is calculated by multiplying the outstanding lease balance of $68,279 by the 5% discount rate, totaling around $3,414. Since a payment is made, the lease liability reduction amount is the difference between the lease payment and this interest component, which is $33,307 ($36,721 payment – $3,414 “Interest”). As we already prepaid the Year 1 rent, there won’t be a reduction to lease liability (remember – the beginning lease liability excluded that). However, we still need to account for the “interest” component, which is calculated by multiplying the outstanding lease balance of $65,028 by the 5% discount rate, coming out to be around $3,251. To recap, we determined the lease liability to be $65,028 (PV of remaining payment excluding the prepaid Year 1 rent).

Prepaid Rent On The Balance Sheet

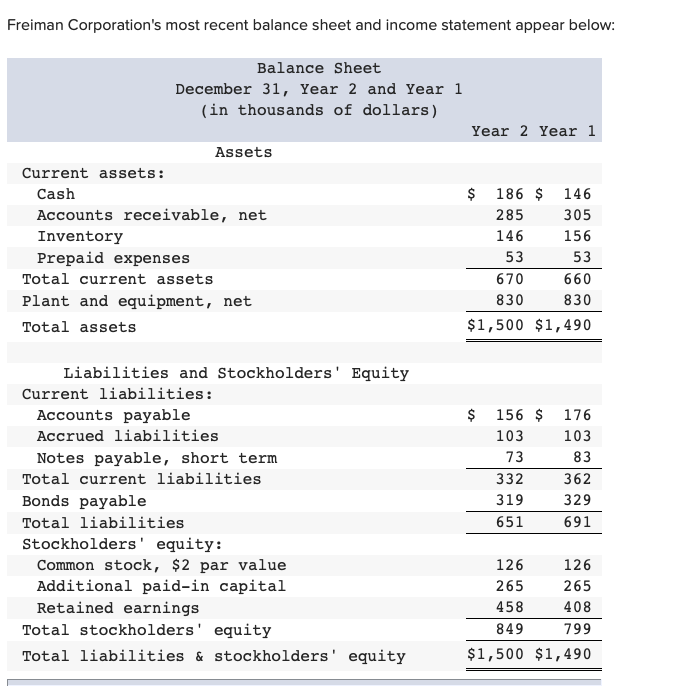

Assets, liabilities and equity are the major accounts that are reported on the balance sheet. An asset is anything of value or a resource with economic value that the company owns or controls with the expectation that it will provide a future benefit. It could be owned by an individual, corporation, or country with the expectation that it will yield future benefits.

- The current assets are the short-term assets that can be quickly converted into cash.

- Prepaid rent is a financial concept that plays a crucial role in the accounting and management of an apartment’s rent payments, both from the perspectives of landlords and renters.

- Organizations must now recognize both an asset and a liability for their operating leases.

- Inflation is an economic concept that refers to increases in the price level of goods over a set period of time.

- To determine whether prepaid rent is an asset, we must first consider whether it meets the definition of an asset.

The matching principle in accounting requires that expenses be matched with revenues in the period in which they are incurred. Prepaid rent is amortized over the period it covers, ensuring that rent expense is recognized in the same period that the rental space is used. We have discussed prepaid rent, the nature of economic transactions such as debit or credit, the balance sheet, income statement recording, and financial reporting. In contrast, prepaid rent is initially presented as an asset on the balance sheet, reflecting the prepayment for future use. This prepayment is initially recorded as an asset on the balance sheet, reflecting the amount of rent paid ahead of time. At the end of the rental period, the prepaid rent has become the expense incurred.

The amount recognized as an expense corresponds to the prepayment portion utilized during the specific period. For example, a business might pay rent for several months or even a year in advance. The method implies that the expenses and revenues should be part of the income statement only in the financial year they are incurred or earned. In this case one asset (pre paid rent) has been increased by 3,000 and the other (cash) has been reduced by a similar amount. When an organization makes a large payment that covers several months, it could be considered a remeasurement of the Lease Liability and ROU Asset and should be accounted for as such.

For example, assume Company ABC purchases insurance for the upcoming 12-month period. Company ABC will initially book the full $120,000 as a debit to prepaid insurance, an asset on the balance sheet, and a credit to cash. According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset. For example, if a large copying machine is leased by a company for a period of 12 months, the company benefits from its use over the full-time period.

The lease term is 120 months (from step 1) and total rent is $15,767,592 (from step 1). Straight-line monthly rent expense calculated from base rent is therefore $131,397 ($15,767,592 divided by 120 months). Deferred revenue should be recorded as an asset and classified as a current asset if it is expected to be realized in the next 12 months. If it is not expected to be realized in the next 12 months, it should be classified as a long-term asset.

CV0.net vous accompagne dans votre recherche d'emploi et permet aux entreprises de partager leurs offres de jobs gratuitement !

CV0.net vous accompagne dans votre recherche d'emploi et permet aux entreprises de partager leurs offres de jobs gratuitement !